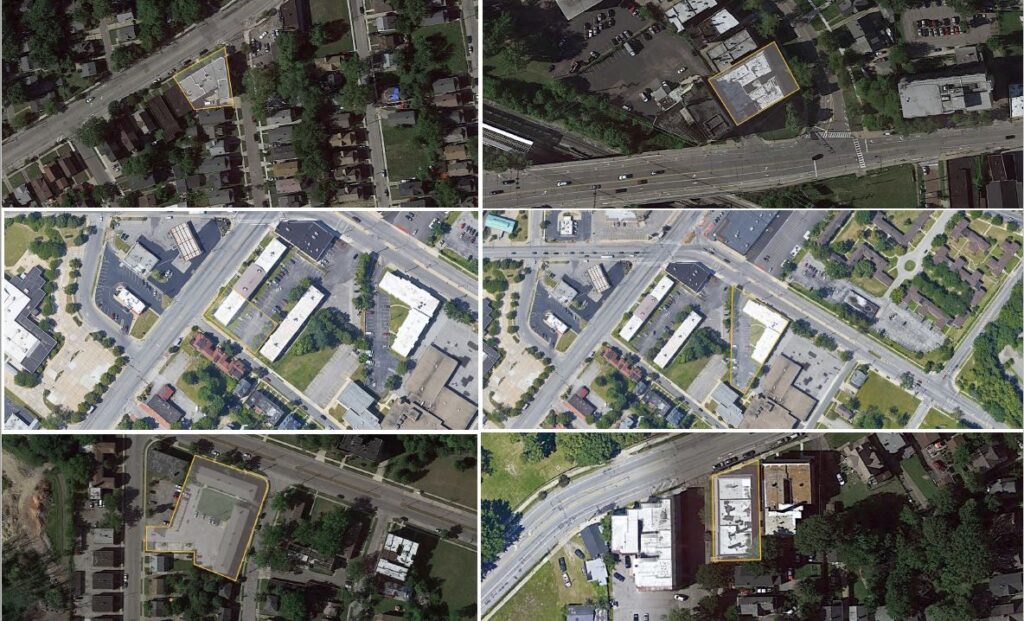

Waller Group is proud to present the 88% occupied, 6 property, 238-unit multifamily portfolio in Cleveland, OH, consisting of 3 buildings built in the 1920’s (81 units combined), 1 built in the 1950’s (34 units), and 2 built in the 1960’s (123 units combined). The portfolio generates $169,160 gross rental revenue per month, with an annual NOI of $679,044 at a cap rate of 6.93%. Proforma financials are underwritten based on a 6.0% economic vacancy to reflect stabilized performance.

The value-add opportunity for this Cleveland portfolio includes optimizing management, stabilizing the occupancy, increasing it from 88% to the market average of 94%, and increasing revenues through additional income. Increasing the occupancy, as well as water conservation measures, along with minor bumps in rent, improve the current NOI from $679,044 to $1,058,370. Additional income could also be generated with application fees, pet fees, collecting late fees, and fines. Ownership is currently paying 3.0% in management fees. New ownership will likely have to source new management.